We Help Underwriters Reduce Risk

Home insurance underwriters use Chrp® to evaluate home assessment reports, make informed decisions, and reduce underwriting risk.

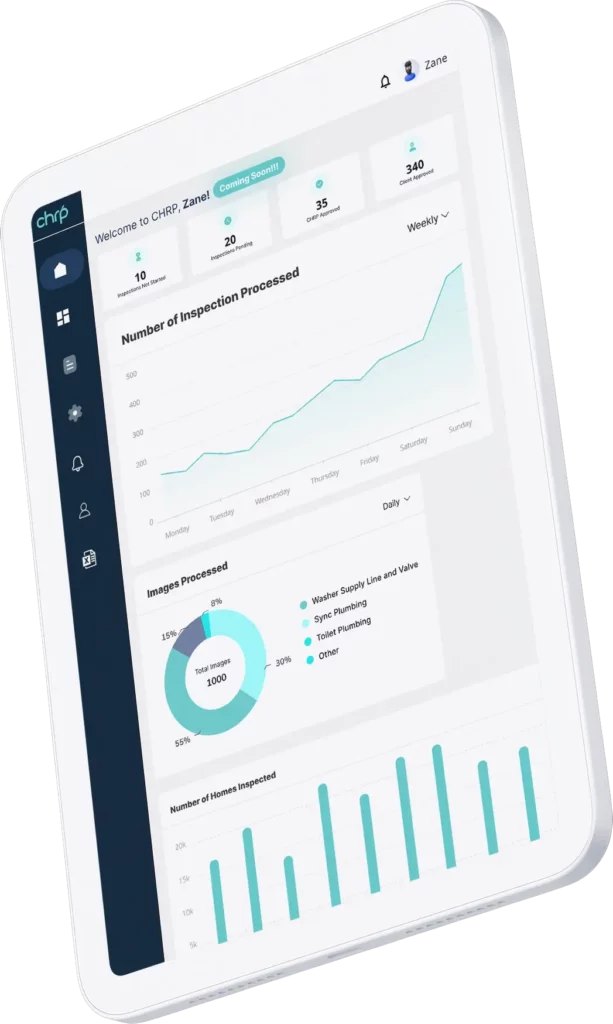

A Single Platform for Home Risk Prevention

Loss Prevention

Utilize Chrp AI models to analyze over 200 inspection points in your own customized ‘4 point inspection on steroids.’

Home Assessment

Tech-based home assessment app for homeowners to assess and protect their home’s value by identifying home insurance hazards.

Underwriting Automation

Automate the new business and renewal underwriting workflow as well as communications between carrier, agent, and homeowner

Expertise + AI

CHRP A.I. leverages 30+ years of experience in insurance and construction to uncover potential future claims often missed in traditional home assessments.

Identify Hazards Before They Become Expensive Claims

Ensure a more profitable book of business by augmenting your inspections with artificial intelligence that catches hazards invisible to the naked eye

Reduce Loss Frequency

CHRP offers the most robust library of use cases covering both underwriting and maintenance inspection points.

Automate Your Workflow

Chrp automatically communicates pertinent information and ensures forward progress on new business underwriting.

What is the Chrp Mobile App?

The Chrp mobile app enables homeowners to conduct a simple, do-it-yourself home assessment.

Interested in working at Chrp?

We are growing and looking for talented ai engineer, front end engineer, middleware engineer, sales, marketing, and operations professionals. Interested in joining our team?